Sunday, December 8, 2013

Saturday, November 23, 2013

Christmas in the Square is Back!!

That's right folks! Returning for it's eighth year, Frisco's Christmas in the Square draws over 650,000 visitors annually and boasts the largest holiday light and music show in North Texas! The fun kicks off Friday November 29th and lasts until January 4th, with an array of events throughout the holiday season! Make sure to bring the family and make this Christmas one to remember!

Visit http://www.friscosquare.com/cits for more info!

Visit http://www.friscosquare.com/cits for more info!

Friday, November 15, 2013

Rio Grande to Open Inside Frisco Whole Foods

The Colorado-based Mexican chain Rio Grande will soon have an additional home in Frisco at the Whole Foods Market shopping center!

Wednesday, November 13, 2013

Frisco Parents Show Frustration With New Attendance Zones

The Frisco school board meeting Monday night was packed to the gills with families, the majority of which were concerned about possible major changes in their kids' future school days.

The plans to redraw attendance zones in preparation for the opening of Independence High School next year was met with opposition from parents whose children live close enough to their current schools to walk or bike.

Many subdivisions, such as Cypress Creek, are only about a mile away from Centennial High, however will be absorbed in to the new Independence Zone.

Much of the frustration stems from the fact that the proposed zones will only be in place for two years before two more high school are slated to open.

Changes to elementary school attendance zones were also up for discussion for the first time Monday as the district prepares to open four elementary campuses next year — Newman, Scott, McSpedden and Hosp, which was named at Monday’s meeting.

The high school zones will be finalized next month, and the elementary zones are set to be adopted in January.

The plans to redraw attendance zones in preparation for the opening of Independence High School next year was met with opposition from parents whose children live close enough to their current schools to walk or bike.

Many subdivisions, such as Cypress Creek, are only about a mile away from Centennial High, however will be absorbed in to the new Independence Zone.

Much of the frustration stems from the fact that the proposed zones will only be in place for two years before two more high school are slated to open.

Changes to elementary school attendance zones were also up for discussion for the first time Monday as the district prepares to open four elementary campuses next year — Newman, Scott, McSpedden and Hosp, which was named at Monday’s meeting.

The high school zones will be finalized next month, and the elementary zones are set to be adopted in January.

Friday, November 8, 2013

Independence High Attendance Zone Up For Discussion This Monday

Monday's Frisco School Board meeting will give the public a chance to provide input on the proposed attendance zones for the soon to open Independence High School.

Set to open in August, Independence will be populated with students from the current Heritage, Centennial and Liberty high school zones. A large number of citizens have already shown frustration with the plan as it will only be in place for two years before another school is said to be needed.

Frisco is also set to open for new elementary campuses next year, the zoning for which will also be open for input on Monday.

Set to open in August, Independence will be populated with students from the current Heritage, Centennial and Liberty high school zones. A large number of citizens have already shown frustration with the plan as it will only be in place for two years before another school is said to be needed.

Frisco is also set to open for new elementary campuses next year, the zoning for which will also be open for input on Monday.

Monday, November 4, 2013

McKinney Set to Purchase Regional Airport

Operations at the Collin County Regional Airport in McKinney will so be taken over by the city as they are nearing a purchase deal.

The 745 acres the aiprort sits on already belongs to the city while George Schuler owns the buildings.

The sale between Schuler and the city is expected to close November 8th.

McKinney expects the $25 million purchase to pay off by combining it with its economic development and corporate recruitment strategy. The city can tout the airport to corporations looking to relocate and offer integrated deals on fuel, hanger leases and other incentives.

The 745 acres the aiprort sits on already belongs to the city while George Schuler owns the buildings.

The sale between Schuler and the city is expected to close November 8th.

McKinney expects the $25 million purchase to pay off by combining it with its economic development and corporate recruitment strategy. The city can tout the airport to corporations looking to relocate and offer integrated deals on fuel, hanger leases and other incentives.

Wednesday, October 30, 2013

Get the Most Bang For Your Remodeling Buck!!

Not all upgrades are created equal. Here are the five home improvements that yield the highest returns!

1. Wood Flooring- Probably the most popular upgrade in recent years, swapping your downstairs tile and carpet mixture for hardwood will increase your home's interior appeal tenfold. In today's uber -competitive seller's market, this can be the difference between a bidding war and being overlooked entirely.

2. Entry Door Replacement- Replacing your stock front door with a steel model not only ups your home's curb appeal, it can also cut energy costs and provides 102.1% average payback when it's time to sell.

3. Kitchen Upgrades- Whether it's granite counter tops or state-of-the-art appliances, very few things turn a buyer's head like a fabulous kitchen. But be sure to consult your local real estate expert before upgrading. Kitchen trends are ever-evolving and it's important to what's "In" and what's "SO last year."

4. Master Bath Remodel- A luxurious master bath is every homeowner's dream. Be careful not to go overboard here. Overly personal installations can hurt resale value. Shower and floor re-tiling, adding a double-vanity, or swapping that old tub for a modern counterpart are some ideas that will appeal to the masses.

1. Wood Flooring- Probably the most popular upgrade in recent years, swapping your downstairs tile and carpet mixture for hardwood will increase your home's interior appeal tenfold. In today's uber -competitive seller's market, this can be the difference between a bidding war and being overlooked entirely.

2. Entry Door Replacement- Replacing your stock front door with a steel model not only ups your home's curb appeal, it can also cut energy costs and provides 102.1% average payback when it's time to sell.

3. Kitchen Upgrades- Whether it's granite counter tops or state-of-the-art appliances, very few things turn a buyer's head like a fabulous kitchen. But be sure to consult your local real estate expert before upgrading. Kitchen trends are ever-evolving and it's important to what's "In" and what's "SO last year."

4. Master Bath Remodel- A luxurious master bath is every homeowner's dream. Be careful not to go overboard here. Overly personal installations can hurt resale value. Shower and floor re-tiling, adding a double-vanity, or swapping that old tub for a modern counterpart are some ideas that will appeal to the masses.

5. Wood Deck- With the long summer in Texas, having an outdoor escape can transform your backyard from wasted space into a major selling point. Not only will your home stand out among the competition, sellers can expect an average 90% return rate at the time of sale.

Monday, October 21, 2013

The Decision

A hush came over the crowd of assembled policy makers and media representatives September 18th as Fed Chairman Ben Bernake took the stage to announce, as reported for months prior, the tapering of the purchase of Treasury Bonds. A program the department has used as a way of nursing the economy back to health.

Only he didn't.

Instead, the rumored $5-$40 billion monthly reduction in bond buying has been pushed back at least until the committee reconvenes in December.What does this mean for the real estate market? In the shadow of the announcement of the Fed's plans to taper buying, mortgage interest rates rose to a two-year high and refinances dropped 70% from the previous year. But in the wake of the hold-off, rates have dipped sharply to a 9-week low as of September 30th.

Those looking to buy can expect a reprieve from their anxiety over rates as they should remain competitive for the time being. This however, is positive news for sellers alike, with buyers no longer fearing getting priced out of this year's historically hot market, home values should keep from slipping as a result of depleted buying power.

While uncertainty remains as to the whens and ifs of the still-expected taper, for now homeowners and buyers alike will enjoy the atmospheric attributes that made this summer such a historic one in real estate. With the combination of comparatively low interest rates and equally low inventory, the metaphorical perfect storm is likely to continue into the coming year. But for homeowners looking for value appreciation over the next half-decade, only time will tell.

Only he didn't.

Instead, the rumored $5-$40 billion monthly reduction in bond buying has been pushed back at least until the committee reconvenes in December.What does this mean for the real estate market? In the shadow of the announcement of the Fed's plans to taper buying, mortgage interest rates rose to a two-year high and refinances dropped 70% from the previous year. But in the wake of the hold-off, rates have dipped sharply to a 9-week low as of September 30th.

Those looking to buy can expect a reprieve from their anxiety over rates as they should remain competitive for the time being. This however, is positive news for sellers alike, with buyers no longer fearing getting priced out of this year's historically hot market, home values should keep from slipping as a result of depleted buying power.

While uncertainty remains as to the whens and ifs of the still-expected taper, for now homeowners and buyers alike will enjoy the atmospheric attributes that made this summer such a historic one in real estate. With the combination of comparatively low interest rates and equally low inventory, the metaphorical perfect storm is likely to continue into the coming year. But for homeowners looking for value appreciation over the next half-decade, only time will tell.

Friday, October 11, 2013

Thursday, September 19, 2013

Home Sales Hit Record High!

The National Association of Realtors reported today that existing-home sales have reached their highest point in six and a half years! This surely do in large part to rising interest rates convincing on-the-fence buyers that now is the time to make their move.

Inventory at the end of August had increased 0.4 percent to 2.25 million homes, at the current rate of sales, this represents a 4.9 month supply. That's slightly down from five months in July and six months a year before that. Home are flying off the shelves and volume is predicted to stay high as interest rates threaten to jump. Down get left out in the cold, if you're on the fence about purchasing your new home, now is the time!

Inventory at the end of August had increased 0.4 percent to 2.25 million homes, at the current rate of sales, this represents a 4.9 month supply. That's slightly down from five months in July and six months a year before that. Home are flying off the shelves and volume is predicted to stay high as interest rates threaten to jump. Down get left out in the cold, if you're on the fence about purchasing your new home, now is the time!

Friday, September 6, 2013

Rates Creeping Back Down

After hitting a two year high last week, mortgage rates have dropped, according to Freddie Macs weekly mortgage report.

Rates have been jumping around recently after beginning their rise in May as speculation mounts that the Fed may soon end its bond-purchasing program, part of what kept rates at or near record lows for the majority of the year.

"The Fed is monitoring the housing market closely after the run-up in mortgage rates over the past few months,” says Frank Nothaft, Freddie Mac’s chief economist. “The 13.4 percent drop in new-home sales in July led financial markets to speculate whether the Fed might delay reducing its bond purchases and allowed long-term bond yields and fixed mortgage rates to decline over the week."

Here are Freddie Mac's national averages for the week ending August 29th:

30-year fixed-rate mortgages: averaged 4.51 percent, with an average 0.7 point, dropping from last week’s 4.58 percent average. Last year at this time, 30-year rates averaged 3.59 percent.

15-year fixed-rate mortgages: averaged 3.54 percent, with an average 0.7 point, dropping from last week’s 3.60 percent average. Last year at this time, 15-year rates averaged 2.86 percent.

5-year hybrid adjustable-rate mortgages: averaged 3.24 percent, with an average 0.5 point, rising from last week’s 3.21 percent average. Last year at this time, 5-year ARMs averaged 2.78 percent.

1-year ARMs: averaged 2.64 percent, with an average 0.4 point, dropping from last week’s 2.67 percent average. A year ago, 1-year ARMs averaged 2.63 percent.

Rates have been jumping around recently after beginning their rise in May as speculation mounts that the Fed may soon end its bond-purchasing program, part of what kept rates at or near record lows for the majority of the year.

"The Fed is monitoring the housing market closely after the run-up in mortgage rates over the past few months,” says Frank Nothaft, Freddie Mac’s chief economist. “The 13.4 percent drop in new-home sales in July led financial markets to speculate whether the Fed might delay reducing its bond purchases and allowed long-term bond yields and fixed mortgage rates to decline over the week."

Here are Freddie Mac's national averages for the week ending August 29th:

30-year fixed-rate mortgages: averaged 4.51 percent, with an average 0.7 point, dropping from last week’s 4.58 percent average. Last year at this time, 30-year rates averaged 3.59 percent.

15-year fixed-rate mortgages: averaged 3.54 percent, with an average 0.7 point, dropping from last week’s 3.60 percent average. Last year at this time, 15-year rates averaged 2.86 percent.

5-year hybrid adjustable-rate mortgages: averaged 3.24 percent, with an average 0.5 point, rising from last week’s 3.21 percent average. Last year at this time, 5-year ARMs averaged 2.78 percent.

1-year ARMs: averaged 2.64 percent, with an average 0.4 point, dropping from last week’s 2.67 percent average. A year ago, 1-year ARMs averaged 2.63 percent.

Tuesday, August 20, 2013

Wednesday, May 29, 2013

Inventory on the Rise!

Housing inventory rose significantly in April, easing a supply shortage that some experts say has constrained home sales.

Meanwhile, existing-home sales edged upwards in April. Still, sales remain hampered due to limited supply and tight credit, according to NAR.

Housing inventory rose 11.9 percent to 2.16 million homes in April, representing a 5.2-month supply of homes at the current rate of home sales. That’s up from 4.7 months in March. But inventory still remained 13.6 percent below a year ago, when there was a 6.6-month stock.

Existing-home sales ticked up 0.6 percent to a seasonally adjusted annual rate of 4.97 million in April from an upwardly revised 4.94 million in March, according to NAR. That put sales at their highest level since November 2009, when a tax credit stimulated purchases, NAR said.

“The robust housing market recovery is occurring in spite of tight access to credit and limited inventory. Without these frictions, existing-home sales easily would be well above the 5-million-unit pace,” said NAR Chief Economist Lawrence Yun. “Buyer traffic is 31 percent stronger than a year ago, but sales are running only about 10 percent higher. It’s become quite clear that the only way to tame price growth to a manageable, healthy pace is higher levels of new-home construction.” Source: realtor.org.

- See more at: http://www.inman.com/wire/home-inventory-rises-sharply-in-april/#sthash.50uhjKPe.dpuf

Meanwhile, existing-home sales edged upwards in April. Still, sales remain hampered due to limited supply and tight credit, according to NAR.

Housing inventory rose 11.9 percent to 2.16 million homes in April, representing a 5.2-month supply of homes at the current rate of home sales. That’s up from 4.7 months in March. But inventory still remained 13.6 percent below a year ago, when there was a 6.6-month stock.

Existing-home sales ticked up 0.6 percent to a seasonally adjusted annual rate of 4.97 million in April from an upwardly revised 4.94 million in March, according to NAR. That put sales at their highest level since November 2009, when a tax credit stimulated purchases, NAR said.

“The robust housing market recovery is occurring in spite of tight access to credit and limited inventory. Without these frictions, existing-home sales easily would be well above the 5-million-unit pace,” said NAR Chief Economist Lawrence Yun. “Buyer traffic is 31 percent stronger than a year ago, but sales are running only about 10 percent higher. It’s become quite clear that the only way to tame price growth to a manageable, healthy pace is higher levels of new-home construction.” Source: realtor.org.

- See more at: http://www.inman.com/wire/home-inventory-rises-sharply-in-april/#sthash.50uhjKPe.dpuf

Monday, May 6, 2013

Wednesday, April 10, 2013

More good news for sellers!

Home prices in Dallas were up another 7 percent year-over-year this spring, posting a median home price of $169,900, though housing inventory continued to dwindle.

The number of homes listed for sale on the market dropped 33% according to a report released Tuesday from ZipRealty, which measured MLS housing data from Feb. 15-March 15.

The rising home prices, coupled with the dwindling number of listings, has created a frenzy that's being seen not just in Dallas, but throughout the country, said Lanny Baker, president and CEO of ZipRealty.

Across the country the median sales price rose to $242,519, a 14.6 percent increase year-over-year, according to the report. The national inventory of home listings decreased 34 percent.

Long story made short, home prices will continue to climb this year as inventory remains at historically low levels.

Monday, April 8, 2013

Prepare your home to beat the heat

With summer quickly approach, I thought this would be a good opportunity to remind readers about some basic home maintenance musts for those sweltering months.

Seal it up!

Energy efficiency is a must when the temperature starts to rise. Have your air conditioning system checked in the spring to beat the rush. Repairmen are often busy in the summer and you may have to sweat it out until your appointment.

Use your ceiling fans as often as possible. I know this is an obvious one but they are a truly energy efficient way to keep the temperature down. Dust them regularly and tighten loose screws.And most importantly, check windows and doors for air leaks and seal with weather stripping or caulk as needed. You’re paying for the cool air, so take steps to be sure it’s not escaping outdoors.

Home Exterior Care and Landscaping

Take advantage of this nice spring weather to wash your windows and siding before the summer months hit. Use a hose rather than a pressure washer to avoid potential damage. Now is also a great time to paint.

Make sure you have your exterminator out to check for termites before it heats up.

In the lawn department, keeping grass cut longer in the summer months will prevent roots from drying out as quickly. Mow regularly but keep some length.

Water in the morning to allow it to soak further into the soil before evaporating.

Also, before planting additional trees and shrubs in your yard, take into consideration the plant's size when mature and whether or not roots might intrude upon underground pipes or paved surfaces such as sidewalks and driveways.

Garage Upkeep

Be absolutely sure to rid your garage of heat sensitive materials before the temperatures increase..

If you have children, instruct them not to go in the garage unaccompanied. Store your hand tools and power tools behind a lock and key. Fertilizers, weed-killers, and pesticides should be stored out of a child’s reach or behind a locked cabinet. You might also consider organic gardening, which employs nontoxic alternatives to these poisonous chemicals.

Driveways And Walkways

Make sure to inspect your driveway regularly throughout the summer for any cracks. Remedy the one's you find immediately. This can be huge in preventing further slipping and serious repair costs in the future.

Make yourself a checklist to help remind you to keep your home up to par all summer long!

Sunday, April 7, 2013

First-quarter new construction way up

Work began on exactly 4,312 new homes in the DFW area since the beginning of 2013. This shows a 35% increase in new home starts and is the highest first-quarter construction volume in five years. Experts attribute the high level of activity to builders reacting to the increasing sales rise and low level of inventory.

Friday, April 5, 2013

Rates down again

Mortgages rates dipped again this week, even as the S&P 500 Index and the Dow Jones remained at record highs. This comes just a day after the Federal Reserve announced it would begin to taper off its stimulus program this summer and end it all together later this year. Average rates on a 30-year fixed were posted at 3.54, down from 3.57 last week and 3.98 this time last year.

Application rates stayed mostly flat this week, coming up only the seasonally adjusted 1 percent.

Tuesday, April 2, 2013

More Millennials Seeing Value in Ownership

Most millennials that make more than $50,000 a year are more interested in buying homes than they were a year ago, a recent survey by homebuilder PulteGroup, Inc. found.

Nearly two-thirds, or 65 percent, of renters between 18 and 34 who responded to the survey and had an income above $50,000 said that their intention to buy has "significantly or somewhat increased in the past year," PulteGroup said.

"Millennials have witnessed the housing boom and bust, but still believe homeownership is a good investment," said Fred Ehle, vice president for PulteGroup, in a statement. "Consistent with other third-party research that shows more than 90 percent of millennials plan to buy a home someday, we see a lot of young adults who are making financial sacrifices to afford a place of their own."

As part of the survey, PulteGroup also polled people on what home aspects matter most to them. The company found that millennials highly value efficient use of space in a home, with 69 percent of respondents indicating that they "overwhelmingly want an open layout space in the kitchen and family rooms for entertaining family and friends."

Millennial survey respondents also said these features were either very important or extremely important to them:

84 percent said ample storage for daily items;

76 percent said space for TV, movie, or sports watching;

73 percent said the entry to the home;

63 percent said an outdoor living space or deck; and,

36 percent said the ability to conduct business from home.

Originally from Inman News - http://www.inman.com/news/2013/04/1/more-millennials-see-homeownership-a-good-investment

Monday, April 1, 2013

Wikipedia of Real Estate Taking Shape

As listing sites ramp up efforts to augment their statistical data with local color, a real estate developer may soon launch a new website devoted solely to delivering qualitative, community information to homeowners, buyers and sellers.

WikiRealty aims to crowdsource information from professionals in all facets of the real estate industry in order to bring the sort of insider information to consumers that they traditionally can only glean from face-to-face interactions with locals, says founder Sanjay Kuttemperoor, a Naples, Fla.-based real estate developer and attorney.

"Getting access to granular location-based information is almost impossible," Kuttemperoor said. "I want [WikiRealty] to be the repository for that kind of information."

Some listing sites already offer platforms designed to provide consumers with on-the-ground community data. Trulia, for example, hosts a forum where professionals and consumers can post questions and comments, and sound off on neighborhood issues.

Such sites appear to be increasing their focus on furnishing consumers with local color. Trulia's new ‘Real Estate Lab' aims to deliver "the inside scoop on the psychology and strategy" of real estate buyers, sellers and professionals in different markets. And RealtyTrac just began partnering with brokerages to obtain local information based on anecdotal feedback.

But WikiRealty's sole purpose will be to collect, organize and display "granular location-based information," according to Kuttemperoor. "This is a different take," he said about the site.

If the "Wikipedia of real estate" takes shape, consumers could avoid encountering surprises late in the home-buying process, he said.

A real estate attorney and developer in Naples, Fla., Kuttemperoor observed one such contingency in his local market, when an architectural control committee began to enforce construction-approval rights that it previously had not enforced, he said.

If WikiRealty was around, attorneys familiar with the matter could have brought the committee's activity to the attention of people thinking about building homes in the community by posting to the site, Kuttemperoor said. That would help them avoid the possibility of having a lien placed on their home after building it without the committee's approval, he said.

The site could also offer a canvas for contractors to showcase their work, similar to home-remodeling site Houzz. An interior designer who just finished a job in a particular community, for example, could post a description and photos about the job, he said. The body of such a post would be limited to 250 characters, but the author would be able to add additional information on a separate page, Kuttemperoor said.

The site even aims to capture the idiosyncrasies of individual properties. Kuttemperoor said. WikiRealty has partnered with a listing syndicator to help achieve this end, Kuttemperoor said. He would not name the syndicator, saying he doesn't have permission to disclose its identity.

As with any crowdsourced website, WikiRealty's success depends on attracting an engaged audience that continually contributes content. Kuttemperoor said he thinks that industry professionals like agents, mortgage brokers and real estate attorneys will volunteer information to the site for exposure to possible clients, who theoretically will visit WikiRealty for the inside scoop on communities.

"The lawyer that posts information is doing that not only because he's well-intentioned but probably also because it brings him clients in the future," Kuttemperoor said.

Kuttemperoor said he plans to launch a beta version of WikiRealty in 30 to 45 days that will serve his local market in Naples, Fla. He said he has been developing the site for two years, and has spent $200,000 out of pocket on it. Other investors have contributed $100,000 more, he said. He added that he is seeking additional capital.

Originally from Inman News - http://www.inman.com/news/2013/03/28/wikipedia-real-estate-taking-shape

Thursday, March 28, 2013

Interest in building, remodeling picks up

A majority of homeowners believe now is a good time to buy or remodel homes, and more of them feel comfortable beginning planned renovations than they did last year, according to a survey commissioned by home-remodeling website Houzz.

Three-quarters of the more than 100,000 homeowners who responded to the "2013 Houzz and Home Survey" said that now is a good time to buy a home, and 53 percent said it was also a good time to remodel, according to Houzz.

The survey hinted at an increase in consumer confidence, with the share of respondents who said they would put off renovations because of economic conditions dropping to 45 percent from 52 percent last year, when Houzz asked the same question.

It also found that, compared to last year, a larger share of homeowners planning renovations would rather save for remodeling than splurge on vacations or other big-ticket purchases. In all, 48 percent of homeowners who responded to the survey are planning to build or remodel a home in the next two years, Houzz reported.

The survey also seemed to indicate that more Americans are interested in increasing the values of their homes. While the vast majority of homeowners who responded to the survey indicated that they conducted their last renovation project in order to improve the "look, flow and layout," 54 percent said they renovated their homes, in part, to increase their home's value. That's up from 47 percent in 2012.

"Together with Commerce Department data showing the rate of single-family home construction at its highest level in four and a half years, the results of this study point to a strengthening economy, housing and renovation market," a report on the survey said.

Houzz's survey received more than 100,000 responses from its 14 million monthly unique visitors. The survey, which was conducted by Edge Research in January and February, covers past and planned renovations as well as the sentiment and motivations behind remodeling projects. Houzz said the survey was the largest ever of its kind.

Other findings of the survey include:

Asked about their priorities when hiring a professional for a project, 67 percent of homeowners surveyed rated a "personality I can work with" as a five on a five-point scale.

Like last year, bathrooms and kitchens were the most popular renovation projects, with 28 percent of respondents planning a bathroom remodel or addition, and 23 percent planning a kitchen remodel or addition in the next two years.

Over the last five years, nearly four in 10 home-improvement dollars have gone into kitchens and survey data indicates future spending will continue to follow that trend.

Over the last five years, homeowners spent an average of $28,030 to remodel their kitchens.

From Inman News - http://www.inman.com/news/2013/03/28/interest-in-building-remodeling-homes-picks

Tuesday, March 26, 2013

Why Dallas Home Prices Keep Rising

Dallas area home prices continued to climb year-over-year, matching expectations in the North Texas residential market, says Ted Wilson, principal of Dallas-based Residential Strategies.

The Dallas metropolitan area's home prices rose 7 percent year-over-year in January, according to Standard & Poor's/Case-Schiller Home Price Indices released Tuesday. Dallas area home prices remained flat in January, compared with the previous month.

"Home prices are still trending upward," Wilson said, of the data. "I'm sure it will go on for the next year or so, as long as the rates stay low."

Low interest rates — about 3.2 percent on a 30-year mortgage — gives homebuyers 30 percent more buying power, which gives room in the market for home prices to rise, he said. Expect home prices to continue to rise if interest rates remain low, Wilson said.

It's unclear how rising interest rates would impact the recovering residential market, he said.

The trend is being seen throughout the nation, with an increase in home prices year-over-year of 7.3 percent in a 10-city composite and 8.1 percent in a 20-city composite, according to the Standard & Poor's/Case-Schiller Home Price Indices report.

Written by Candice Carlisle - http://www.bizjournals.com/dallas/news/2013/03/26/ted-wilson-the-reason-behind-rising.html?iana=ind_rre

Sunday, March 24, 2013

Global Luxury Market Still Growing

The international luxury real estate market remains relatively immune to the economic and political trends that drive the general housing market and is off to strong start in 2013, according to a report from high-end real estate affiliate network Christie's International Real Estate.

The report compared 10 top property markets around the world: London, New York, Hong Kong, Paris, San Francisco, France's Cote d’Azur, Toronto, Dallas, Los Angeles, and Miami. The company, a subsidiary of Christie's auction house, also rolled out a new index, the Christie's International Real Estate Index, which ranks markets across metrics such as record sales price, prices per square foot, percentage of non-local and international purchasers, and the number of luxury listings relative to population.

The 10 markets were also chosen for the network's strong market share locally. Christie's International Real Estate has 125 affiliated brokerages in 41 countries.

London, which topped the index, achieved a record sales price of more than $121 million for a residential property in 2012, followed by an $88 million sale in New York. In all of the cities studied except Dallas and Toronto, the highest sales price for the year exceeded $35 million, the report said.

Economist Robert Shiller has predicted U.S. home prices will rise only one or two percent a year in inflation-adjusted terms for the next half decade due to "lingering uncertainties" in world economies, the report said. By contrast, a study by the The Boston Consulting Group expects global sales of personal luxury goods, such as fine art, to grow about 7 percent annually through 2014, assuming there are no new major economic crises, the report added.

"Except where there is government intervention luxury residential real estate values will likely follow luxury goods and not the general housing market, and are therefore poised to increase in many of the cities studied in 2013," the report said. "This is particularly true as (high-net-worth individuals) turn their luxury investments toward nonconsumables and experiential luxury products that have lasting value."

Bonnie Stone Sellers, CEO of Christie's International Real Estate, said in a statement that "strong momentum" in the luxury property market "is also being driven by scarcity of quality inventory and demand from international buyers in many of the world's top destinations."

There are more billionaires worldwide now than before the 2008 financial crisis and 55 percent more millionaires than in 2000, the report said.

"This is a large part of the reason the cities surveyed have done so well: the international crossborder purchaser has continued to buy the trophy properties at top dollar," the report said.

This is particularly true for buyers from countries where local economic uncertainty encourages the rich to park their cash in international cities least affected by the global downturn. In seven of the 10 cities studied, more than 30 percent of the luxury homebuyers were from other countries.

High-net-worth individuals "find the world to be a small place, and geographical distances between cities are not relevant to purchasing patterns, which are more similar to each other in the 10 cities surveyed than other cities within the same country," the report said. "Globalization, economic development, wealth deposits, and technology attract HNWIs to the key global urban centers, where knowledge, capital, and culture intersect."

In the most of the cities studied, the share of all-cash deals rose with the sales price. Nearly 100 percent of Los Angeles transactions above $5 million were in cash, followed by 90 percent in New York and 70 percent each in San Francisco and Miami.

Recent tax law changes in many of these markets will likely have a negative effect on 2013 high-end market activity, the report said. For instance, in Toronto, new restrictions on mortgage financing intended to cool the housing market, are expected to lengthen days on market for luxury properties, which have hovered at 46 days for the past two years.

"Government actions relating to taxation and lending standards can significantly influence buyers worldwide, including luxury home buyers. In nearly all of the cities examined, recent changes to capital gains taxes, wealth taxes, transfer taxes, mortgage restrictions, and secondary residence taxes have created notable catalysts in the market," the report said.

Originally by Inman News - http://www.inman.com/news/2013/03/11/global-luxury-real-estate-market-showing-strong-momentum

Friday, March 22, 2013

Dallas is the most affordable place to live in the U.S.

Dallas is the most-affordable major metropolitan area to live in the United States, according to a report by ZipRealty, which measures the national housing market.

The ranking is based on median household income and the median home prices. This is the first year ZipRealty has compiled this data, which measures 30 metropolitan areas throughout the country.

Dallas' median household income is $47,418 with the median home price of $249,950, which gives it a home price to median income ratio of 5.27. That ratio of home price to income is the lowest in the country, said Lanny Baker, president and CEO of Calfornia-based ZipRealty Inc. (NASDAQ: ZIPR)

"My sense is that the economy in Dallas is healthier today than it's been for awhile," Baker said, attributing his opinion to North Texas' stable income levels. "That hasn't yet translated into higher housing values."

The favorable ratio of income to housing prices could bring in folks from other parts of the country, where housing prices are higher than Dallas. The median home price throughout the country is $299,500, which is about $50,000 more than Dallas' median home price.

"Dallas isn't inflating as fast as other areas of the country," Baker said, adding that San Francisco, Sacramento and Las Vegas are seeing significantly higher home prices year-over-year through the first quarter of 2013.

Houston has the second-most-affordable housing market, followed by Minneapolis, with a 5.43 and a 5.5 index, respectively, Baker said.

Some of the most expensive places to live in the country based off the index include Washington, D.C., Brooklyn and the San Francisco area.

Written by Candace Carlisle - http://www.bizjournals.com/dallas/news/2013/03/20/why-dallas-is-the-most-affordable.html?iana=ind_rre

Wednesday, March 20, 2013

The Hottest Spots in Dallas!

For people seeking a new home, Dallas-Fort Worth is one of the most exciting markets in the United States. In an interview, Jeff Ferguson, a Dallas real estate agent with Virginia Cook Realtors, cited it as the "sixth strongest real estate market in the country." Homebuyers would be hard-pressed to find a poor real estate market in any DFW neighborhood, yet Ferguson pointed out three of the hottest markets in Dallas: Downtown and Uptown, the area around the Jesuit College Preparatory School of Dallas, and Richardson.

Hottest Real Estate Market in Dallas: Downtown and Uptown

Thanks to their location and the recently opened park over Woodall Rodgers Freeway, Downtown and Uptown are the most exciting real estate markets in Dallas-Fort Worth right now. According to Ferguson, being close to Dallas' center is key. People want to live inside the Loop, preferably at the center of the city. No neighborhood is more centrally located in Dallas than Uptown and Downtown.

In the past, these two neighborhoods were divided by Woodall Rodgers Freeway. In October 2012, Klyde Warren Park opened on top of Woodall Rodgers Freeway. As the park's website says, it "creates green space 'out of thin air' that connects the vibrant Uptown neighborhood with the Dallas Arts District and downtown." Ferguson noted how this green space has already attracted pedestrians and made the area more pleasing to prospective home buyers.

These neighborhoods are still lacking a supermarket, he mentioned. However, Klyde Warren Park's restaurant, which is slated to open late this summer, might be the first of many new food establishments to move into this area.

Great Investment Real Estate in Dallas: The Jesuit Neighborhood

When discussing Dallas' various neighborhoods, Ferguson was excited about the real estate investment possibilities in the area around the Jesuit College Preparatory School. Just below I-635 along Inwood Road, this neighborhood is within the Loop and close to the Dallas North Tollway.

Ferguson's experience has shown that the prices of older homes in this North Dallas neighborhood are often between $350,000 and $400,000, which is an affordable home price compared to Highland Park and University Park. However, new homes around the school often sell for around $1.2 million. This gap between older and newer home prices is a developer's dream. Ferguson has seen several developers purchase an older home, tear it down, and build a new one, which they quickly sell at a significant profit.

Excellent Family Homes Near Dallas: Richardson

Richardson is technically a suburb of Dallas, but it is barely outside the City of Dallas' limits. When comparing the North Dallas suburbs, Ferguson favored Richardson over Plano, Grapevine, and others. He mentioned Richardson's proximity to I-635 and I-75 as a positive, as they make Richardson one of the most accessible suburbs. He has noticed families favor this Dallas-area neighborhood because it has a strong school system and the housing is relatively inexpensive. "Richardson is exciting. It's very affordable, yet it's adjacent to high-end communities like the Park Cities," said Ferguson.

Written by - Robs Toccs - http://news.yahoo.com/3-hottest-real-estate-markets-dallas-2013-173200203.html

Tuesday, March 19, 2013

Monday, March 18, 2013

Texas Real Estate Continues Upward Trend!

A renewed sense of urgency has filtered into Texas real estate, particularly in cities like Dallas. The frequency of home sales, low inventory and decreased number of foreclosure sales continue to heat up the buying frenzy, which is only expected to increased in 2013. Nationwide, it seems that home buying interest has regained momentum but Texas specifically seems to be growing by leaps and bounds:

Prices of pre-owned homes grew by 8% compared to 2011

Total sales ran 17% higher in 2012

The median price for homes has surged by nearly $100,000

Home builds are forecast to increase by as much as 15% in 2013

Adding to this new speculation and activity is the fact that the Federal Government is keeping interest rates low, which means that mortgage financing should stay at historic lows at least through the next year. This will not only reinforce the new purchases and speculation but invite buyers and sellers who until now have stood on the sidelines waiting for signs of a revitalized real estate market. Regardless of inventory, demand continues to pick up steam, especially in cities like Dallas and Plano.

There is also additional evidence to suggest that as prices continue to rise in parallel with demand, home owners who have held onto inventory, will be more motivated to move their properties up for sale. Such an increase in supply will additionally spur more speculative purchases from investors watching a renewed Texas real estate industry continue to pick up speed. In short, buying a home in Dallas will be an intensive process requiring patience and in-depth research. Partnering with an informed ally will be of the utmost importance.

Call me today at 817-657-6213 to take advantage of some of the best market conditions in history!

Article by Patrick Glaros - http://www.dallasmortgageplanners.com/dallas-real-estate-news/texas-real-estate-trending-upwards-as-the-calendar-turns/

Prices of pre-owned homes grew by 8% compared to 2011

Total sales ran 17% higher in 2012

The median price for homes has surged by nearly $100,000

Home builds are forecast to increase by as much as 15% in 2013

Adding to this new speculation and activity is the fact that the Federal Government is keeping interest rates low, which means that mortgage financing should stay at historic lows at least through the next year. This will not only reinforce the new purchases and speculation but invite buyers and sellers who until now have stood on the sidelines waiting for signs of a revitalized real estate market. Regardless of inventory, demand continues to pick up steam, especially in cities like Dallas and Plano.

There is also additional evidence to suggest that as prices continue to rise in parallel with demand, home owners who have held onto inventory, will be more motivated to move their properties up for sale. Such an increase in supply will additionally spur more speculative purchases from investors watching a renewed Texas real estate industry continue to pick up speed. In short, buying a home in Dallas will be an intensive process requiring patience and in-depth research. Partnering with an informed ally will be of the utmost importance.

Call me today at 817-657-6213 to take advantage of some of the best market conditions in history!

Article by Patrick Glaros - http://www.dallasmortgageplanners.com/dallas-real-estate-news/texas-real-estate-trending-upwards-as-the-calendar-turns/

Wednesday, March 13, 2013

Interest Rates Remain at All-Time Low, Now is the Time!

Home loans are still quite a bargain.

The average cost of 30-year, fixed-rate mortgages, the most popular way to finance a home, up less than a quarter of a point since reaching a record low in early December.

The average cost of a 15-year mortgage, which is very popular with borrowers looking to refinance a home, is back below 3%.

It looks like long-term interest rates are bouncing along what could be a long and profitable bottom for home buyers and owners.

We can probably count on cheap home loans as long as the Federal Reserve is determined to hold borrowing costs at historic lows until our lethargic economy is growing faster and creating more jobs.

The only question is whether the Fed's rate-setting committee is wavering on that commitment — a concern raised by the minutes of its most recent meeting.

Call Agent Brian Force today to take advantage of this record breaking opportunity! 817-657-6213

Originally posted by Mike Sante - http://www.interest.com/mortgage/news/mortgage-rates/

Sunday, March 10, 2013

North Texas Real Estate Off the Charts!

There’s good news for North Texas home owners. In fact, the Texas real estate market has largely managed to exceed projections, and being that it has showed little slow-down, many experts believe it is poised to thrive in 2013 as well. 2012 ended with record numbers, and inventory levels that are at all-time lows.

Realtors® around the state have reported a surge in interest on behalf of buyers. In November, sales inventory dropped to the lowest level in more than a decade thanks to a surge in North Texas home sales.

As DD Flynn, VP Marketing with Prudential Texas Properties, notes, “We expect the North Texas real estate market to continue to flourish in 2013. As more and more potential sellers realize the health of the market, we do expect inventory levels to rebound to a certain degree, giving prospective home buyers even more opportunities to find what they’re looking for. ”

During the first 11 months of 2012, North Texas home sales were up 17% and pre-owned home sales in the area have been on the rise for nearly 18 months. In the meantime, this does have Realtors® scrambling to find available properties for their clients, but as word gets out regarding the resurgence in the real estate sector, more sellers are expected to re-enter the game.

One thing that will certainly help is an uptick in median sales prices. In November, prices climbed 11% throughout the area, but the Northwest Dallas real estate market saw especially large gains at 52%. Experts believe that many sellers will start to list homes in the next six months to a year.

Flynn notes, “The Texas real estate market is still very much full of potential homes to purchase, but you just have to be willing to do some extra legwork in order to find that perfect property. Partnering with an expert real estate agent who knows the local market is one way to get a leg-up in the game.”

Another bright spot for the local real estate market is the low unemployment rate. At 6.2%, this is the lowest unemployment rate for the state of Texas in four years. As the economy at large continues to improve, including adding more jobs in industries like trade, transportation, and utilities, leisure and hospitality, education and health services, and more, the real estate market is expected to move in tandem with it.

Realtors® around the state have reported a surge in interest on behalf of buyers. In November, sales inventory dropped to the lowest level in more than a decade thanks to a surge in North Texas home sales.

As DD Flynn, VP Marketing with Prudential Texas Properties, notes, “We expect the North Texas real estate market to continue to flourish in 2013. As more and more potential sellers realize the health of the market, we do expect inventory levels to rebound to a certain degree, giving prospective home buyers even more opportunities to find what they’re looking for. ”

During the first 11 months of 2012, North Texas home sales were up 17% and pre-owned home sales in the area have been on the rise for nearly 18 months. In the meantime, this does have Realtors® scrambling to find available properties for their clients, but as word gets out regarding the resurgence in the real estate sector, more sellers are expected to re-enter the game.

One thing that will certainly help is an uptick in median sales prices. In November, prices climbed 11% throughout the area, but the Northwest Dallas real estate market saw especially large gains at 52%. Experts believe that many sellers will start to list homes in the next six months to a year.

Flynn notes, “The Texas real estate market is still very much full of potential homes to purchase, but you just have to be willing to do some extra legwork in order to find that perfect property. Partnering with an expert real estate agent who knows the local market is one way to get a leg-up in the game.”

Another bright spot for the local real estate market is the low unemployment rate. At 6.2%, this is the lowest unemployment rate for the state of Texas in four years. As the economy at large continues to improve, including adding more jobs in industries like trade, transportation, and utilities, leisure and hospitality, education and health services, and more, the real estate market is expected to move in tandem with it.

Friday, March 8, 2013

Dress to impress!

Stage It, Sell It, Profit!

Turn on any popular home network on cable TV and you’ll find a program on staging.

Re-arrange your furniture, pick a soothing color palette, clear out the family photos, and your home will sell faster, and for more money. Sound too frou-frou to be true?

It’s not! The soft and decorative side of staging is backed by hard facts.

Real estate agents like great-looking homes because they are easier to sell. Why is that important?

An agent’s job is to please their clients, and they will direct their buyers to the homes they think they will buy.

Agents talk to other agents who are also directing their buyers to the best homes on the market. An attractive listing will be shown more often, meaning more market exposure—critical for a quick and profitable house sale.

Staging is non-negotiable in many parts of the country. Staging a listing for sale in an area where the concept hasn’t caught on can give you an advantage, particularly if there are many unsold listings similar to yours on the market. Buyers gravitate to listings that look good and are in move-in condition.

Buyers are looking for value. When prices are flat or on the decline, buyers need to perceive that the house is worth the price.

Bottom line: staging is more than an exercise in tasteful interior design. It is a business decision that can have a huge impact on your financial return and timeline.

Thursday, March 7, 2013

Median sales increases again!

The median list price in March for single family homes in Dallas is $269,250. The list prices increased by 7.74% from the previous month. Market experts are still debating the reasoning for low market inventory in a strongly favored sellers market.

Wednesday, March 6, 2013

Here an offer, there an offer, everywhere an offer!

A staggering 86% of listings taken by the KW Preston Road office getting multiple offers! If you're ready to sell for top dollar contact me today! 817-657-6213

Tuesday, March 5, 2013

Five cool tech ideas for your home

For many obvious reasons, stress is a real bummer, and the more we experience the harder it can be to deal with. Here are a few simple things to try next time you're feeling the pressure or stress of life.

1. Laser Robot Vaccuum

This awesome little robot by Neato Robotics does the dirty work for you. Not only will it clean the house after you go to sleep, but it has a special laser that maps the home. This little guy knows where it’s been and where it hasn’t, and when it’s done it drives itself back in the closet!

2. Heated driveway

If you live in a cold weather state, shoveling snow is a dreaded fact of life. What if you could throw the shovel away? Heated driveway technology, utilizing mats and cables within the driveway, can eliminate strenuous snow removal from your life.

3. Thermal Imaging Gun

High energy bills taking their toll? Try the Black and Decker thermal leak detector. With this little guy you can check your home for energy leaks. The infrared thermometer will detect leaks and let you know where the hot and cold spots are.

4. Sun Tunnel

Looking to add natural light but a sky light may not be viable? Try the Velux Sun Tunnel. This cool flexible tube can find its way around obstructions and deliver a perfect amount of light into your room.

5. Wireless Can Light Speaker

The Klipsch LightSpeaker system gives you the best of both worlds. This wireless speaker screws right into your can lighting. It even comes with an efficient LED light.

Dallas foreclosure rates continue to drop!

Dallas area foreclosure rates continued to remain well below the national average and continued to decline for another straight year in 2012.

Dallas posted a 1.17 percent foreclosure rate in December, decreasing 0.28 percentage points year-over-year, according to data released Tuesday by California-based CoreLogic(NYSE: CLGX).

This was significantly lower than the national average of 2.96 for the month of December.

In addition to the declining foreclosure rate, mortgage delinquency rates also decreased in December. In the North Texas area, mortgage loans that were 90 days or more delinquent fell to 4.28 percent compared with 5.1 percent year-over-year.

This continuing trend is a largely contributing factor to some of the lowest interest rates on record! Buyers beware, your dream home is waiting just around the corner!

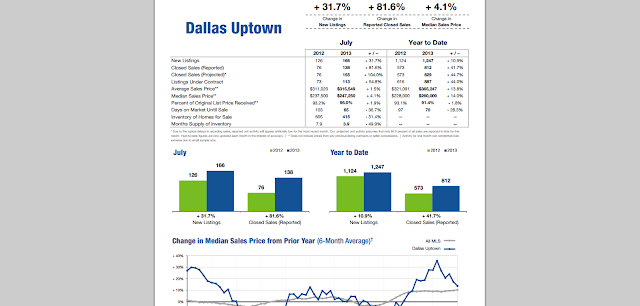

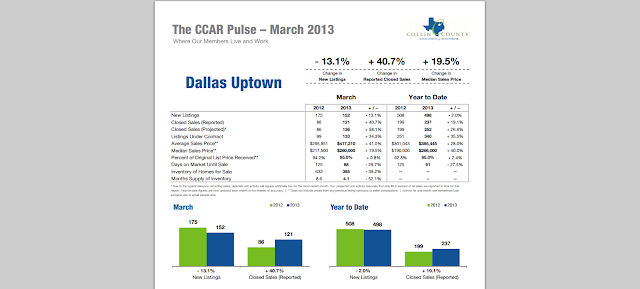

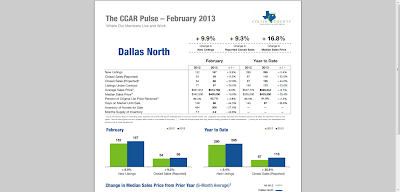

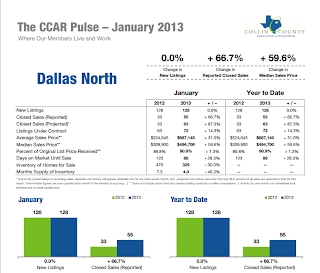

North Dallas Home

Sales Up 67% From Last Year! Now is the Time!

If you just so happen to be innocently pondering where the

market has been lately, I feel obliged to inform you that it is officially

BACK! January home sales in North Dallas were up a whopping 66.7% from last

year! This to kick off a year that follows a 2012 that saw a 25% in sales over

the year before, the news just seems to keep getting better!

What does all this mean for potential sellers? The market is

yours! If you're one of the thousands of owners waiting for the perfect time to

sell, unsure of the climate and whether to expect getting a reasonable price

point, the wait is over. A market that was marred by high interest rates and a

surplus of inventory now flaunts some of the lowest interest rates on record

and less than a three month supply of inventory as opposed to the six one can

expect in an average climate. Conditions have set the stage where bidding wars

become a normalcy and sellers confidently demand top dollar. Refer to the

figure below for more details on this skyward trend.

Wednesday, February 27, 2013

ATTENTION FIRST-TIME BUYERS!!

There has never been a better time to purchase your first home! According to the National Association of Realtors, home sales in North Texas were up 23% in January from the previous year and are continuing to rise. With this uptrend in sales, interest rates are continuing to come down! This could be the perfect time to get in to your new place! To find out more check out brianforce.kwrealty.com or contact my office at 972-468-5202!

Subscribe to:

Posts (Atom)